Thriving in a Digital Society — Modernizing Legacy Banking Applications

March 10, 2022

For more than half a century, banks have been at the frontier in embracing automation and introducing digital systems to gain operational excellence. Today, their demands have grown and banks now look beyond their legacy core banking systems that have been, to date, leveraged for conventional services such as opening up new accounts, processing deposits and transactions, and initializing loans.

Digital innovations are disrupting the marketplace and the continuous evolvement and spurt of technologies have now radically put these legacy systems back in the race. New players are beginning to enter the market without the burden of outdated technologies.

The rise of Fintech startups, teeth-gritting competition, and the fast-paced digital momentum have exponentially elevated consumer expectations and have forced banks to modernize their digital assets.

What is Core Banking Modernization?

Core banking modernization is the replacement, upgrade or outsourcing of a banks’ existing core banking systems and IT environment, which can be scaled and sustained to perform mission-critical operations for the bank, empowering it to harness the power of advancements in technology and design.

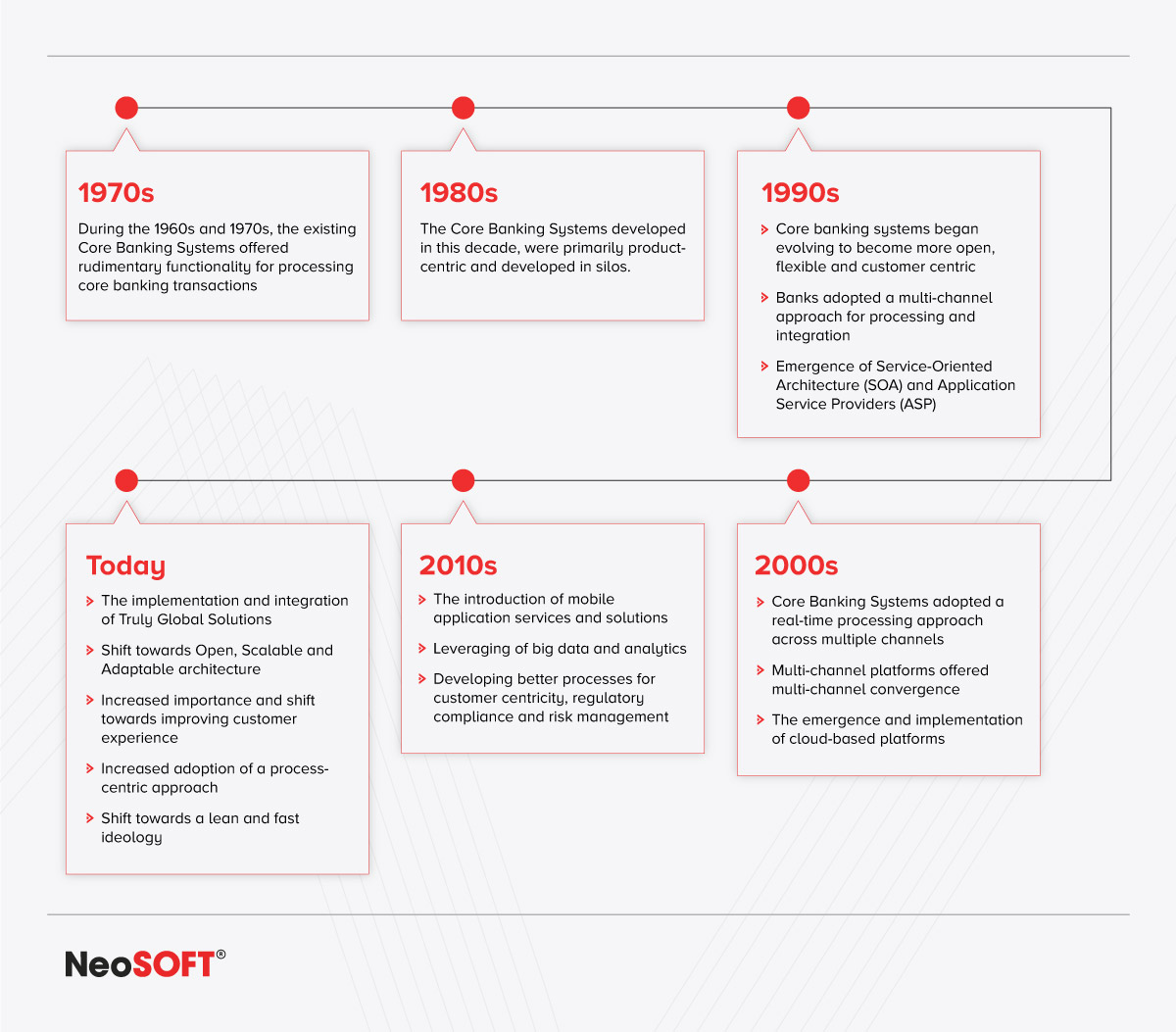

Banking Yesterday, Banking Today, and Banking Tomorrow

The core banking solutions of the future shall accommodate global perspectives so that it gets easier for the banks to deploy systems across multiple geographies. In comparison with the legacy systems, these new systems shall be more lean, scalable, process-centric, economical, and deployed over the cloud which shall empower banks to be agile and meet the changing business requirements.

EVOLUTION OF CORE BANKING SYSTEMS BY DECADE

In pursuit of embracing innovative features and scaling customer experience, the banks are at a disposition where they seem to be keen on accepting data-driven and cutting-edge technologies, and lean and agile processes. This transformation is disruptive and banks need to strike the right balance between revitalizing their core systems vis-à-vis creating new products and services to thrive in a digital society.

To address the challenges of the near future and the next normal, it is necessary to conduct a thorough assessment of the current core banking platform and external environments. Modernizing legacy applications is a critical process and it requires a disciplined and well-thought approach. Banks will need to understand whether a full replacement or a systematic upgrade will offer a better value-to-risk ratio.

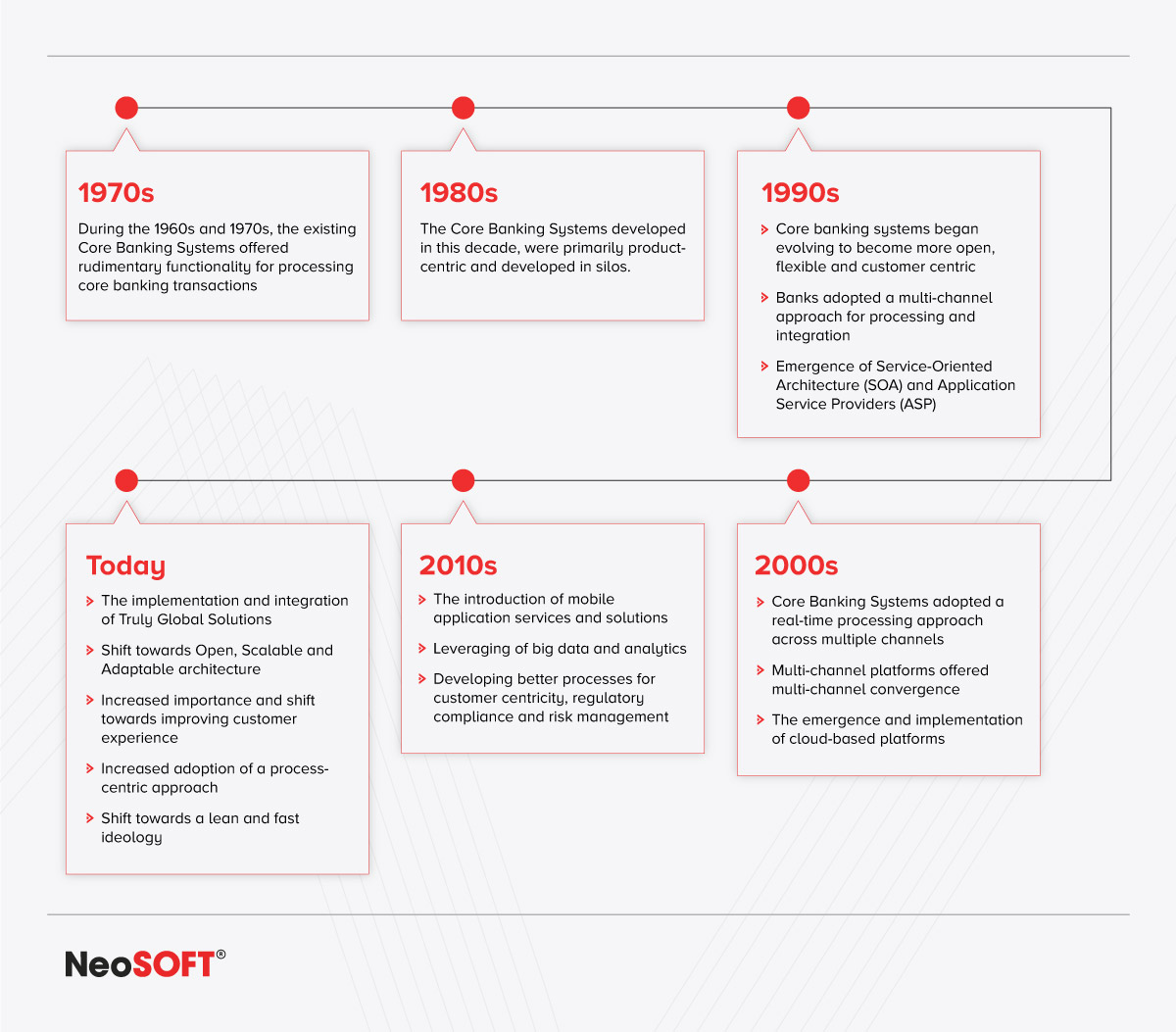

Modernization Objectives and Drivers

Core banking modernization is driven by the need to respond to internal business imperatives such as growth and efficiency as well as the external ones such as regulations, competition, and customer experience expectations.

As new banking products, channels, and technologies enter the marketplace, the complexity and the necessity to modernize old legacy core banking systems becomes more crucial. The internal and the external drivers pushing the banks to transform are worth consideration.

Internal Drivers:

- Product and Channel Growth

Managing high volumes of product-channel transactions and payments demand scalable and sustainable modern core banking systems. The introduction of ever-increasing custom solutions/products to satiate a wide segment of customers which is further amplified with multifarious channels creates an opportunity for banks to re-strategize their old digital assets. - Legacy Systems Management

With technologies that had been used to build the legacy systems getting obsolete, finding resources to manage these outdated systems also gets difficult. Moreover, introducing new technologies into the systems benefit the banks in staying relevant, achieving flexibility and cost-effectiveness. - Cost Reduction

Modernizing core applications involves consolidating the other stand-alone applications that stand peripheral to the core. This subsequently optimizes the overall cost and helps banks in reducing the high maintenance costs associated with legacy systems.

External Drivers:

- Regulatory Compliance

It is imperative for the banks to enhance their IT infrastructure and operations in order to comply with increasing regulations such as Basel III, Foreign Account Tax Compliance Act (FATCA), and the Dodd-Frank Act, all of which are aimed at 1) Enhancing risk management 2) Governance procedures and, 3) Improving transparency of banking operations that also involves customer interactions. - Increasing Competition

The competition pressure compels banks to innovate and embrace new core banking platforms. The new entrants in financial services are speculated to give banks a tough run and start questioning their purpose of existence. - Customer Centricity

Customer experience is a derivate of many components and banks need to re-strategize their positioning. Moving from a product-centric to a customer-centric approach is highly necessary. Focus on customer service, relationship-based pricing, and digital experience shall be the crucial elements in the transformation journey.

OBJECTIVES OF CORE SYSTEMS TRANSFORMATION

Best Practices in Core Banking Modernization

- Evaluate Technical Debt: Banks should be able to closely identify and calculate their technical debt so that they can properly prioritize the debt and its impact on the legacy system processes. To get an accurate assessment, banks will need to factor in the prospective cost of adding or altering features and functionality later.

- Outline the Organization’s Objectives and Analyze Risk Tolerance: When going for legacy system modernization, the bank must assess various business variables like customer satisfaction levels, modernization objectives, cost savings, business continuity, and risk management. These thorough assessments will help to provide context for the selection of the most efficient and effective modernization approach.

- Choose Futuristic & Advanced Solutions: Technology refinements are taking place at an unprecedented scale, which demands organizations to be agile in the adoption of future technologies. For this, it is critical to build solutions that support future adaptability.

- Define the Post-Modernization Release Strategy: The most crucial modernization practice is to create a follow-up plan that includes successful training of employees, ensuring systematic and streamlined process, timely update schedule, and undertaking other maintenance tasks.

Legacy modernization will empower traditional banks in performing a wide range of modern banking services which shall be robust and scalable. Moreover, the digitalization of traditional banks shall address the changing needs of customers through seamless digital services and drive excellent customer experience.

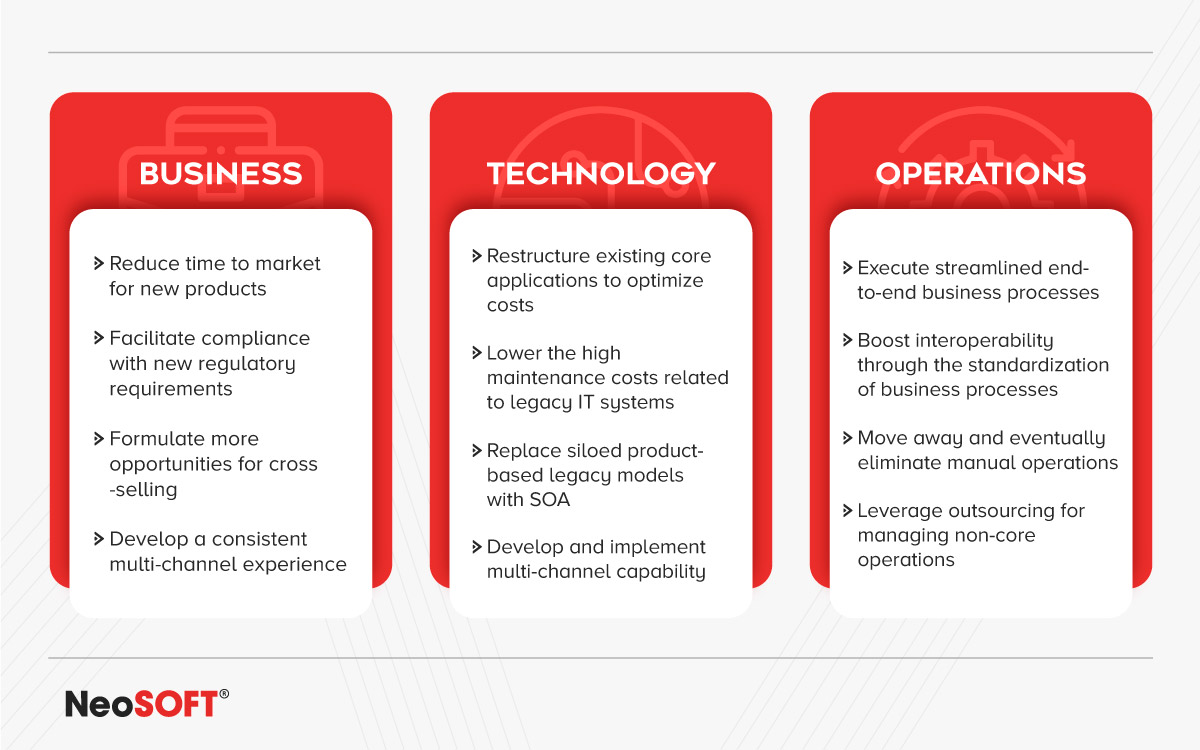

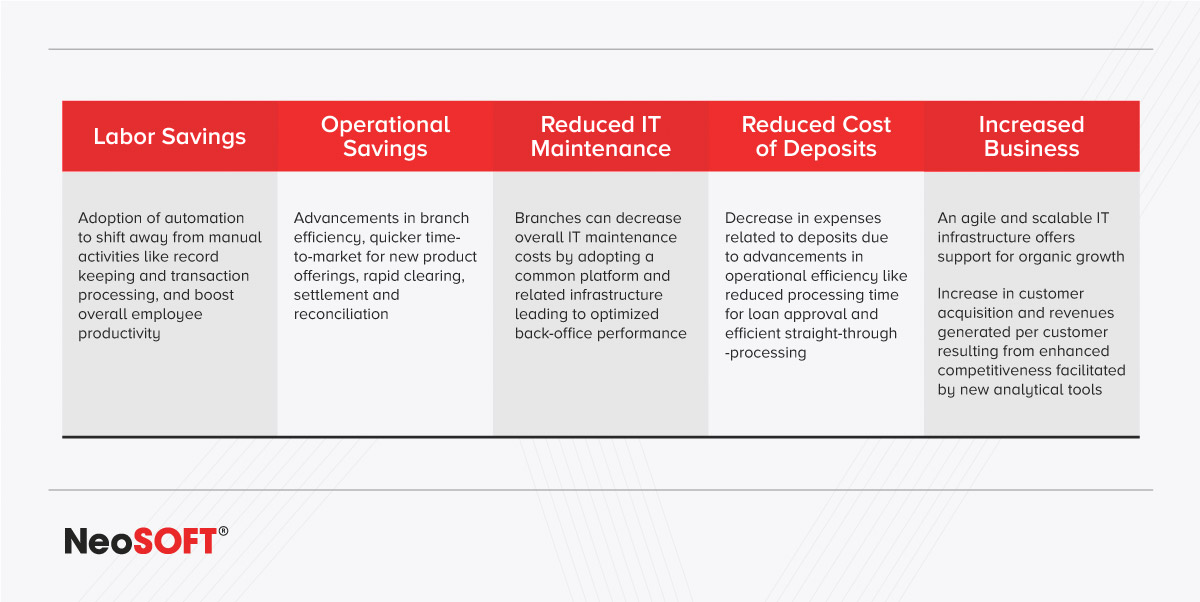

Legacy Modernization Benefits

- Faster Customer Onboarding: Deploy cutting-edge technologies such as Artificial Intelligence, Blockchain, Data Science, etc. to speed up the customer onboarding process. Remember, that the customer experience is a derivative of the way banks engage with them and makes their life easier and better.

- Omnichannel Banking Experience: Your online and mobile banking software should not only match but supersede the banking experience drawn at your physical banks. This simply means that the virtual banking experience of your customer should be seamless, personalized, and secured.

- Scalability and Flexibility: Your banking application should be able to onboard any number of users and be fit for massive user access at the same time. Cloud adoption is proving to improve efficiency, security, and reduced costs.

IMPACT AREAS OF LEGACY MODERNIZATION

The Way Forward

As the world tunes in to the new normal, the solution to legacy systems is the modernization of core banking systems. Banks looking to enhance their IT efficiency are sorting to innovative technologies of AI/ML, IoT, Cloud Computing, Blockchain, and RPA. The integration of new technologies shall help in unlocking the growth and revenue potentials of banks whilst building a loyal and satisfied customer base. It also enables real-time systems that are agile, scalable, flexible, and cost-effective.

Now is not the time to mull over the prospect of banking legacy software modernization. It is only the survival of the fittest, and to stay fit, banks and financial institutions must weather the storm and adapt to the new rapid evolution of Fintech. This however can’t be a solitary journey!

Get in touch with NeoSOFT’s Application Modernization Experts to get a free consultation towards your first step in the modernization journey.