Fighting Financial Fraud: AI and Machine Learning in Action

Introduction

Rapid developments in AI and machine learning are streamlining the financial services landscape. Spreadsheets, incoherent systems, and manual processes have given way to a smart, data-driven ecosystem that can detect risk, automate complex activities at scale, and improve customer intelligence.

Real-time insight extraction is becoming an edge in competition as customer data volume and diversity continue to increase. With little to no input from humans, intelligent computerized systems can analyze vast amounts of both structured and unstructured data, uncovering trends and patterns that were previously unknown.

In an era where hyper-personalized digital experiences are influencing customer preferences and operational efficiency is required rather than discretionary, this capacity is especially important. In addition to enhancing decision-making and lowering risk, financial institutions are utilizing artificial intelligence technologies to create more straightforward, scalable, and future-ready technology that meets contemporary demands.

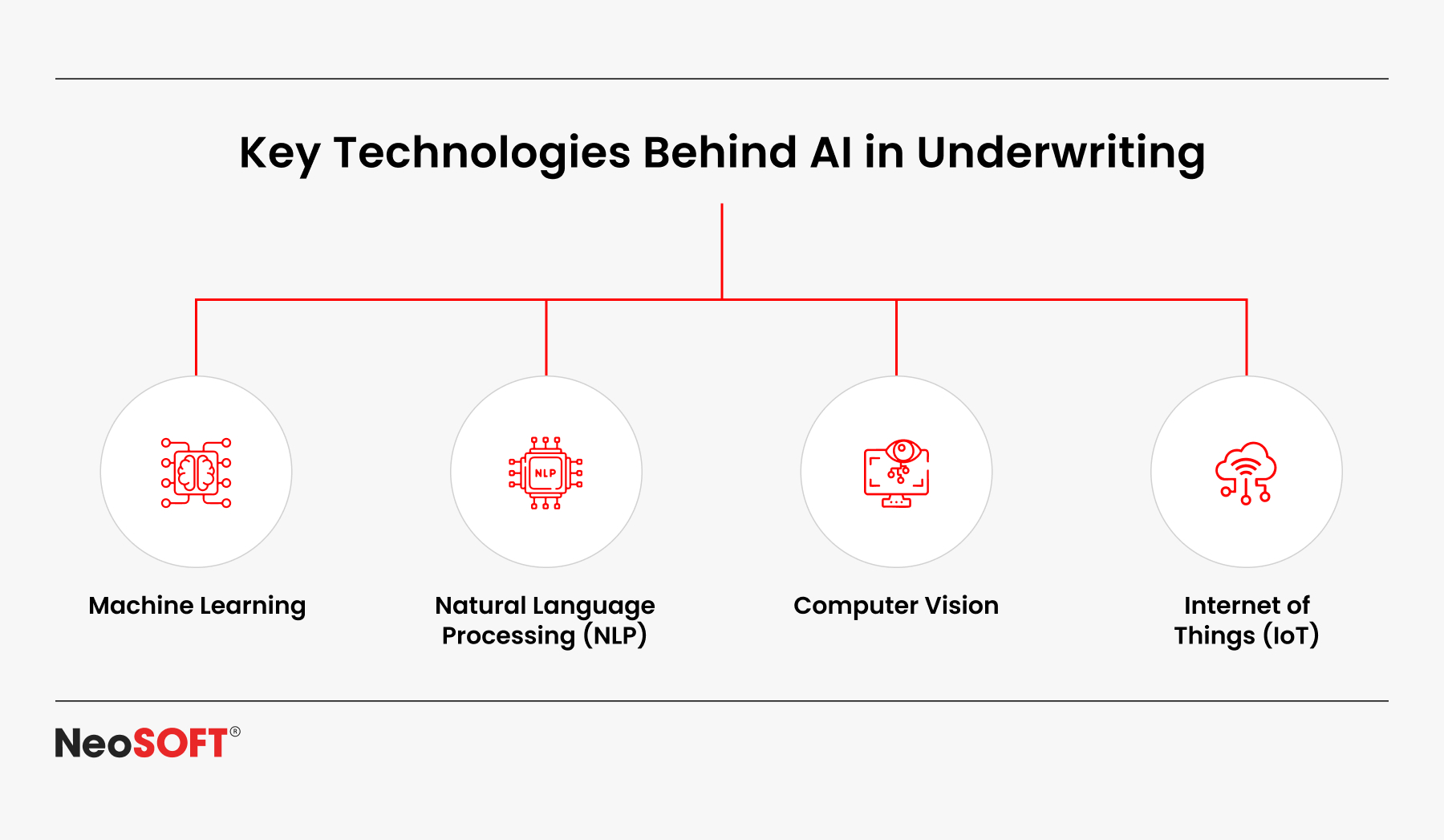

Financial institutions, tech managers, and leaders in the insurance, financial services, financial planning, and fintech industries are the target audience for this blog. Through the use of technologies including natural language processing, neural networks, and machine learning algorithms, this blog intends to examine how artificial intelligence (AI) and machine learning (ML) are transforming concerns ranging from fraud detection and risk control to customer experience and regulatory compliance.

Furthermore, you will also learn about the function of neural networks, both supervised and unsupervised training, and other machine learning methods. This blog offers practical insights that can assist you create genuine value throughout your financial organization, regardless of whether you’re simply investigating AI possibilities or trying to scale your present systems.

Why Machine Learning Is Mission-Critical for Financial Institutions

The environment in which financial institutions operate at present, is marked by enormous amounts of both structured and unstructured data. The problem is not a shortage of knowledge, but rather how to analyze it effectively and extract useful data from transaction records, credit histories, customer contacts, and regulatory filings.

Machine learning systems, in contrast to static systems, improve in accuracy and dependability with each iteration as they are trained using new input data. A smarter, quicker, and safer financial ecosystem that predicts requirements, lowers risks, and improves the consumer experience is the end result.

Building powerful machine learning models that can classify data, identify deviations, and carry out particular tasks with little or no input from professionals depends heavily on data quality and the thoughtful selection of training data.

In order to understand consumer behavior, spot trends, and provide highly customized services, financial institutions are now utilizing both supervised and unsupervised learning. Even with a small amount of labeled data, supervised and semi-supervised reinforcement learning approaches contribute to improving model accuracy.

In accordance with this change, the demand for more intelligent credit scoring, forecasting of risks, and fraud protection systems is expected to propel the international artificial intelligence market in finance to grow at a compound annual growth rate (CAGR) of 22.4% through 2028.

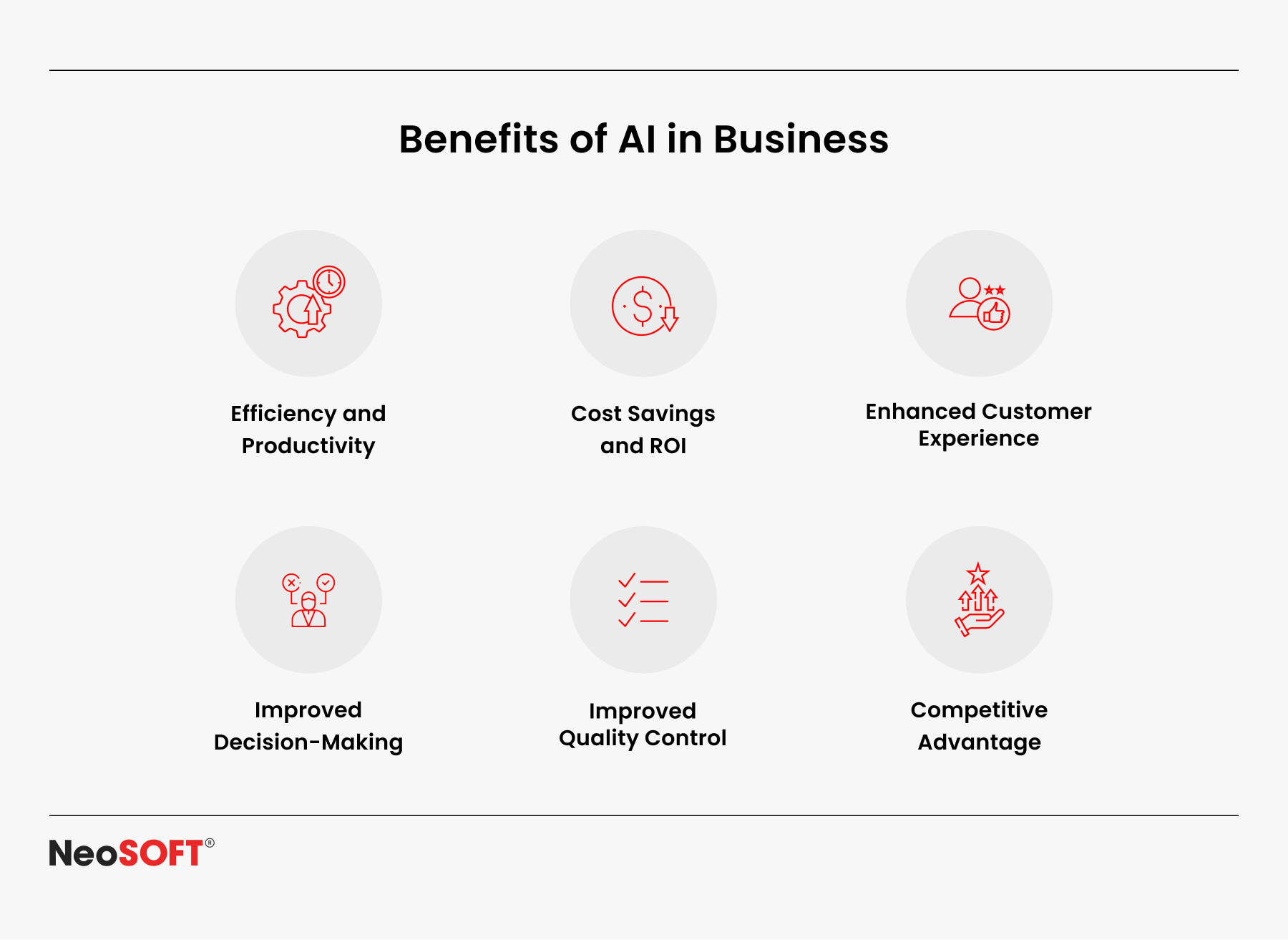

Key outcomes of integrating AI and ML in finance include:

- Automating processes traditionally handled through manual tasks using AI technologies, reducing errors, and increasing operational efficiency. From optical character recognition to virtual assistants and speech recognition, machine learning tools automate processes once dependent on human effort.

- Analyzing customer data and customer behavior to generate actionable insights that help financial institutions understand user preferences and meet rising customer expectations. By combining supervised machine learning and unsupervised learning, systems learn to tailor offerings for both existing and new customers.

- Enhancing risk management and fraud identification in real time through advanced machine learning models such as integrating support vector machines (SVM’s), convolutional neural networks, and deep learning systems with more than three layers. Such tools could improve data protection across the banking and finance industry by identifying suspicious activity sooner than traditional methods.

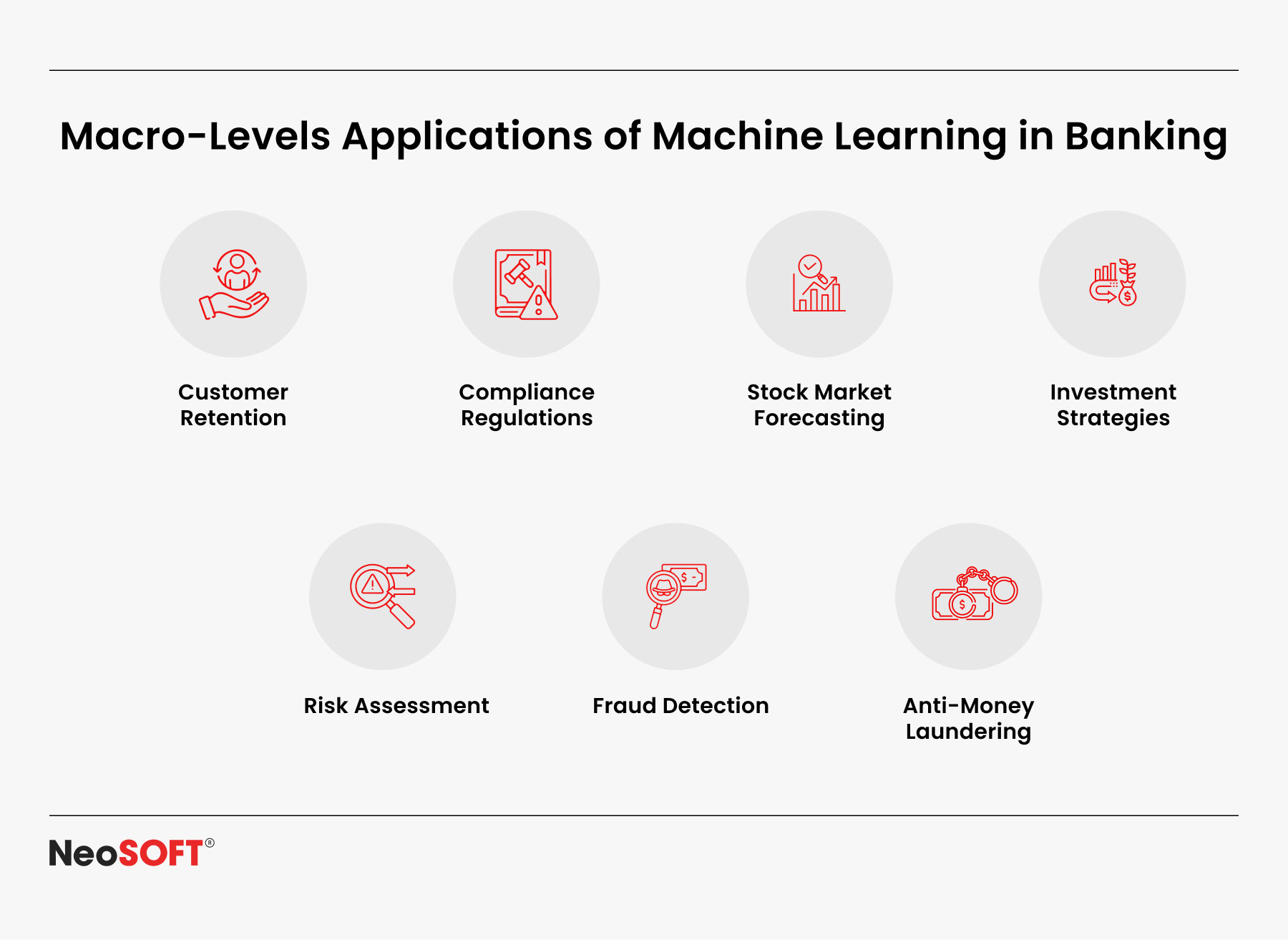

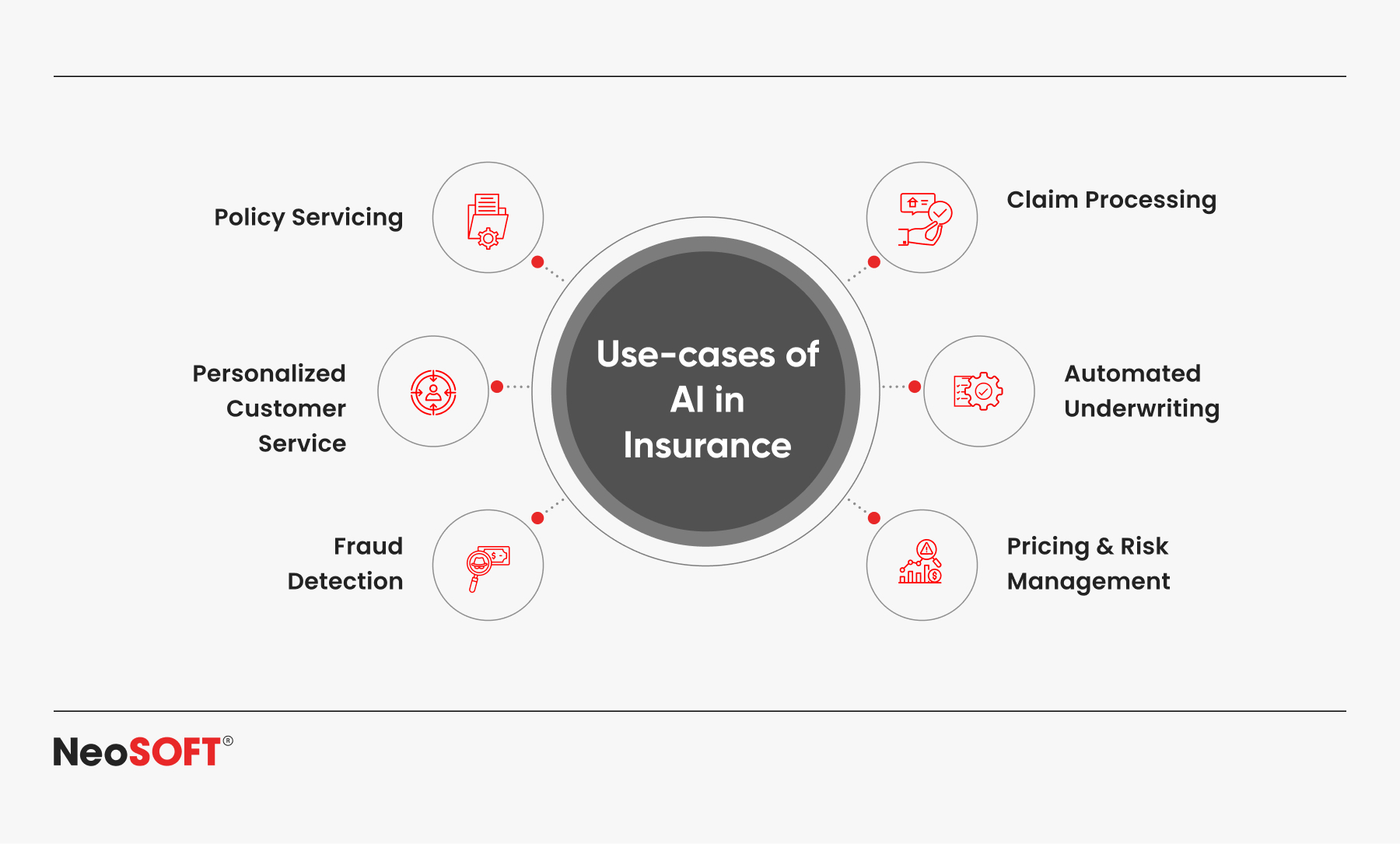

Key Applications of AI and ML in Financial Services

1. Risk Management & Fraud Detection

Machine learning systems use large quantities of historical data and training data to identify patterns that are abnormal and prevent fraudulent activity. Support vector machines (SVMs), and artificial neural systems, for instance, can go through tons of data points to flag suspicious transactions.

The banking and insurance industry is quickly adopting intelligent models to identify anomalous patterns and minimize fraud attempts in real time, since the majority of U.S. banks have already included AI throughout their fraud detection systems.

These models continuously improve with feedback, enabling more accurate detection over time and adapting to evolving fraud tactics.

2. Customer Intelligence and Personalization

By analyzing customer interactions, user preferences, and behavioral trends, AI technologies help the banking industry deliver hyper-personalized services. These insights come from supervised learning models trained to predict the next best product or service.

Machine learning technology helps banks move from reactive service to proactive engagement nudging customers toward smarter financial choices without human intervention.

3. Automated Loan Processing and Credit Scoring

Using supervised and unsupervised learning, lenders evaluate new applicants more accurately. They now factor in alternative data sources like social behavior, location history, and digital footprints alongside traditional structured data.

ML algorithms like linear regression and decision trees help classify data and determine creditworthiness faster than ever before.

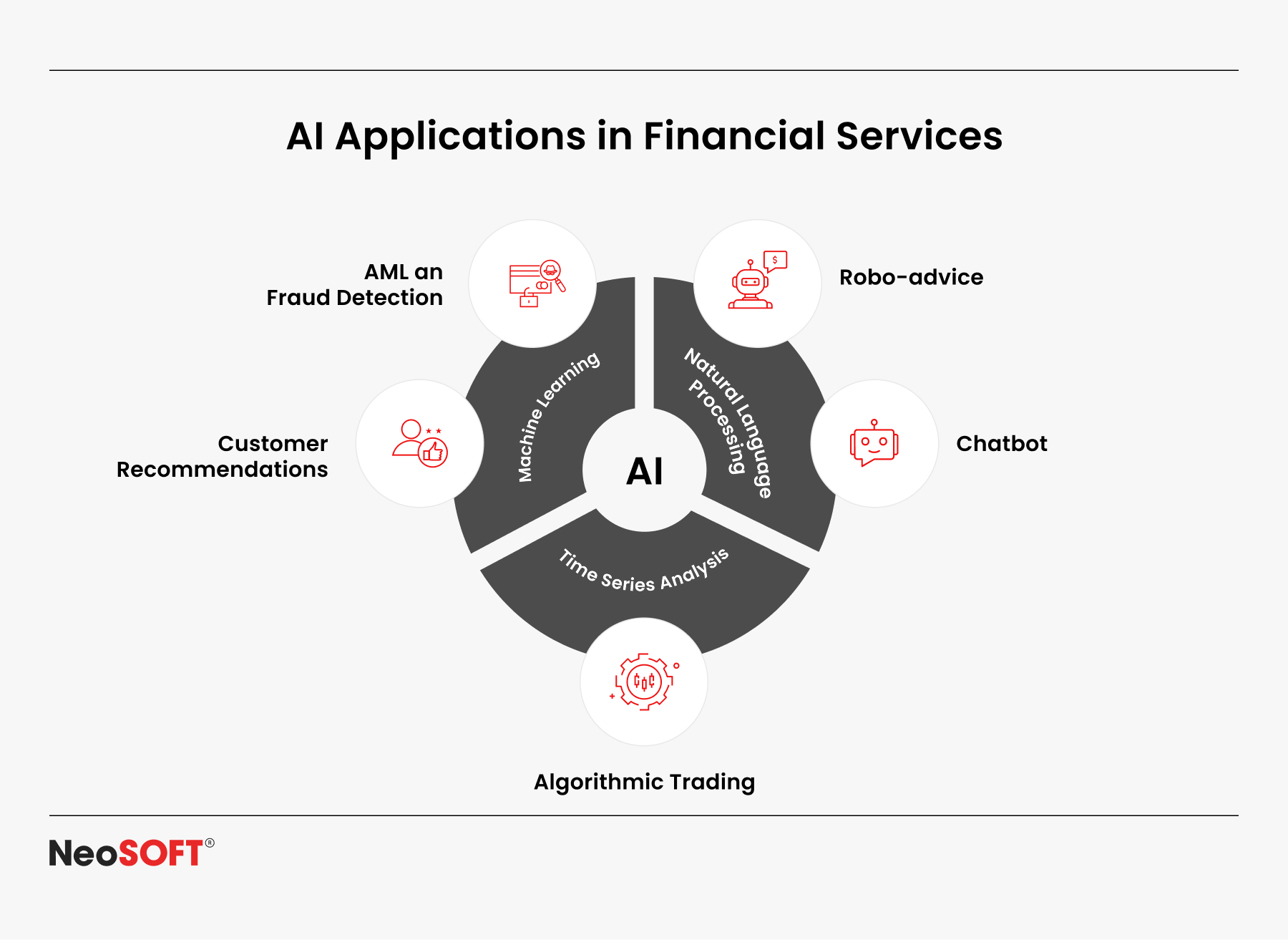

4. Virtual Assistants and Customer Support

AI-powered virtual assistants and chatbots driven by natural language processing, also known as NLP and speech recognition, are being used by banks and insurers to manage standard inquiries and transactions. These AI programs produce quick responses saving on employees’ time to work on more important projects.

By handling repetitive queries, NLP-driven bots minimize agent workload and escalate only complex cases.

5. Regulatory Compliance and Document Processing

Technologies like computer vision and optical character recognition (OCR) help with the digitization and segmentation of regulatory documents. AI systems employ autonomous machine learning to find hidden patterns in enormous quantities of documentation, simplifying compliance business operations.

This minimizes the possibility of mistakes being made in regulatory reporting while simultaneously speeding up audit readiness.

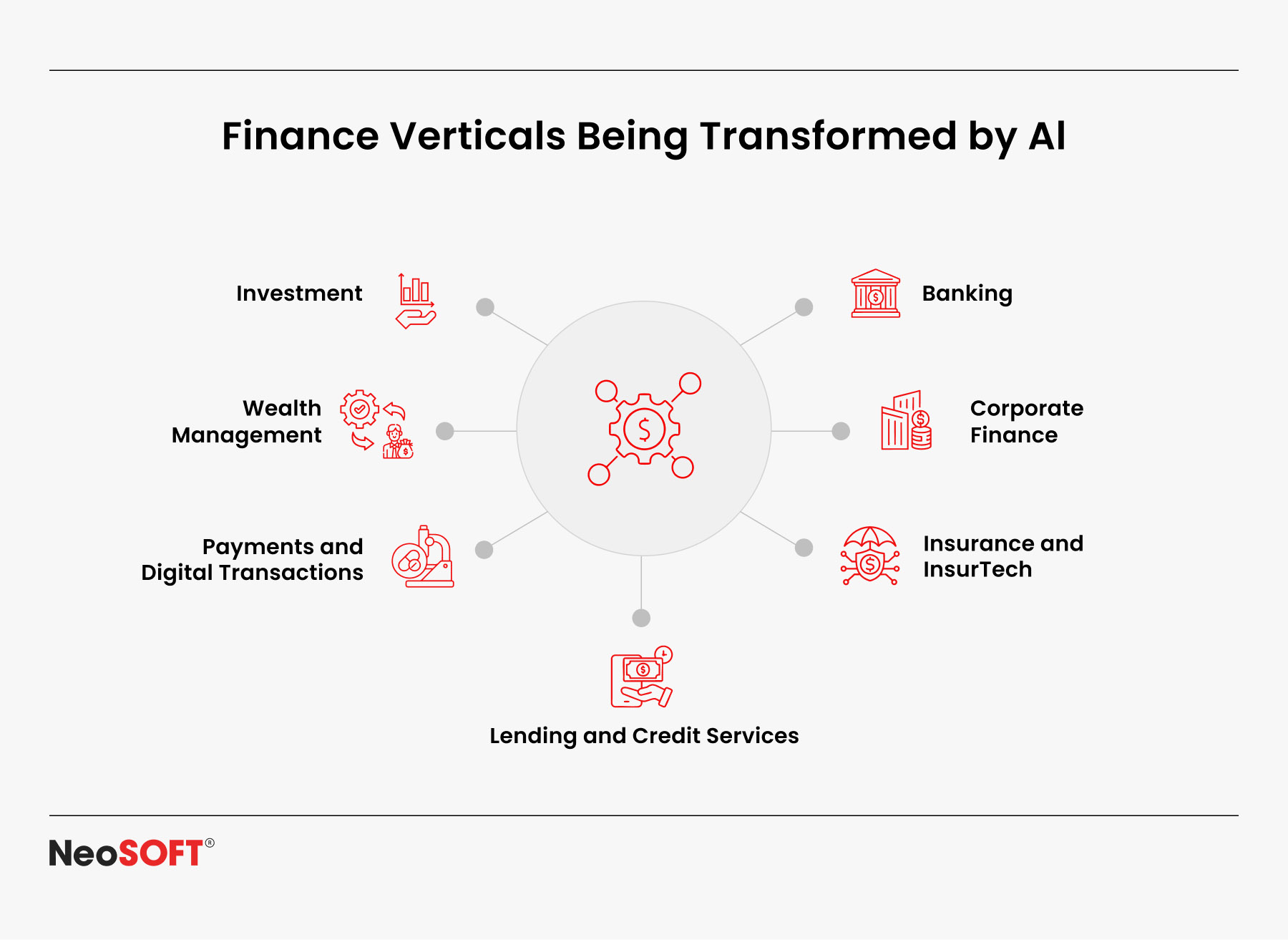

How Financial Institutions Leverage Machine Learning Across Departments

- Retail Banking: Natural language processing, as mentioned before, and picture recognition are examples of machine learning techniques that make customized products and automated enrollment recommendations possible, improving user experience and engagement.

- Wealth Management: By examining customer habits and market data, forecasting and reinforcement learning may optimize portfolios and provide individualized investment plans.

- Insurance: Automation of claims are powered by deep learning and synthetic neural network algorithms (ANNs), which uncover hidden patterns in unstructured information to expedite processes.

- Compliance: Real-time tracking of transactions is done by unsupervised machine learning models, which highlight abnormalities to lower risk and improve compliance.

The Role of Data Science in Financial Machine Learning

1. Preparing Training Data from Structured and Unstructured Sources

Data science assists in combining unstructured data, like social networks and call center transcripts, with structured data, such transactions and customer profiles, in an effort to generate comprehensive trained datasets.

2. Cleaning and Labeling Data for Quality

In machine learning, the reliability of the data is crucial. Data scientists use supervised learning to reliably identify data after cleaning it up by repairing mistakes and properly labeling it. Proper labeling enables the training of models to detect anomalies with high precision, classifying them into two categories: authentic or fraudulent in fraud detection.

3. Building and Evaluating Machine Learning Models

Data scientists construct and assess methods like SVMs, neural networks with deep layers, and reinforcement learning to solve money-related problems. After learning from historical data, these models which incorporate artificial neural networks are assessed based on metrics like precision and accuracy to ensure successful results, such as spotting fraud or projecting market movements.

4. Continuously Updating Data for Model Optimization

Machine learning models must be regularly updated with new data in order to remain up to date. To help models perform better over time, data scientists feed them real-time input. In forecasting for estate planning or fraud detection, for example, this ongoing learning guarantees that models continue to be flexible in response to evolving consumer habits and market scenarios.

5.Combining Data Science with Financial Expertise

Organizations can create more precise models that tackle issues unique to their sector by fusing computational science using domain-particular financial expertise. From risk management to personalized customer service, this combination guarantees that machine learning systems can handle financial difficulties with efficacy.

The Technology Behind the Digital Transformation

The powerful learning algorithms that drive machine learning systems are at the heart of the financial revolution. These technologies, such as semi-supervised learning models and convolutional neural networks, or CNNs, for image identification, are allowing machines to evaluate large volumes of data effectively.

For instance, CNNs are often used in fraud detection applications, where they can spot irregularities by analyzing visual patterns in papers, transactions, and sometimes video streams. CNN algorithms mimic the visual processing powers of the human brain by collecting features from images, resulting in quicker and more accurate evaluations than traditional methods.

Furthermore, because semi-supervised learning models can handle labeled and unlabeled data, they are quite useful when getting a lot of labeled data is expensive or time-consuming. These models make use of both labeled and unlabeled data, enabling systems to evolve and get better over time as more information becomes accessible.

Whether they are applied to analyzing information, financial pattern estimation, or automated execution of repetitive tasks, these machine learning techniques allow AI systems to replicate fundamental neurological processes like pattern recognition, decision-making processes, and problem-solving skills at machine speed.

AI systems react to changing financial environments by continually gaining knowledge from fresh data, which boosts decision-making skills, improves client experiences, and enhances industry-wide operational effectiveness.

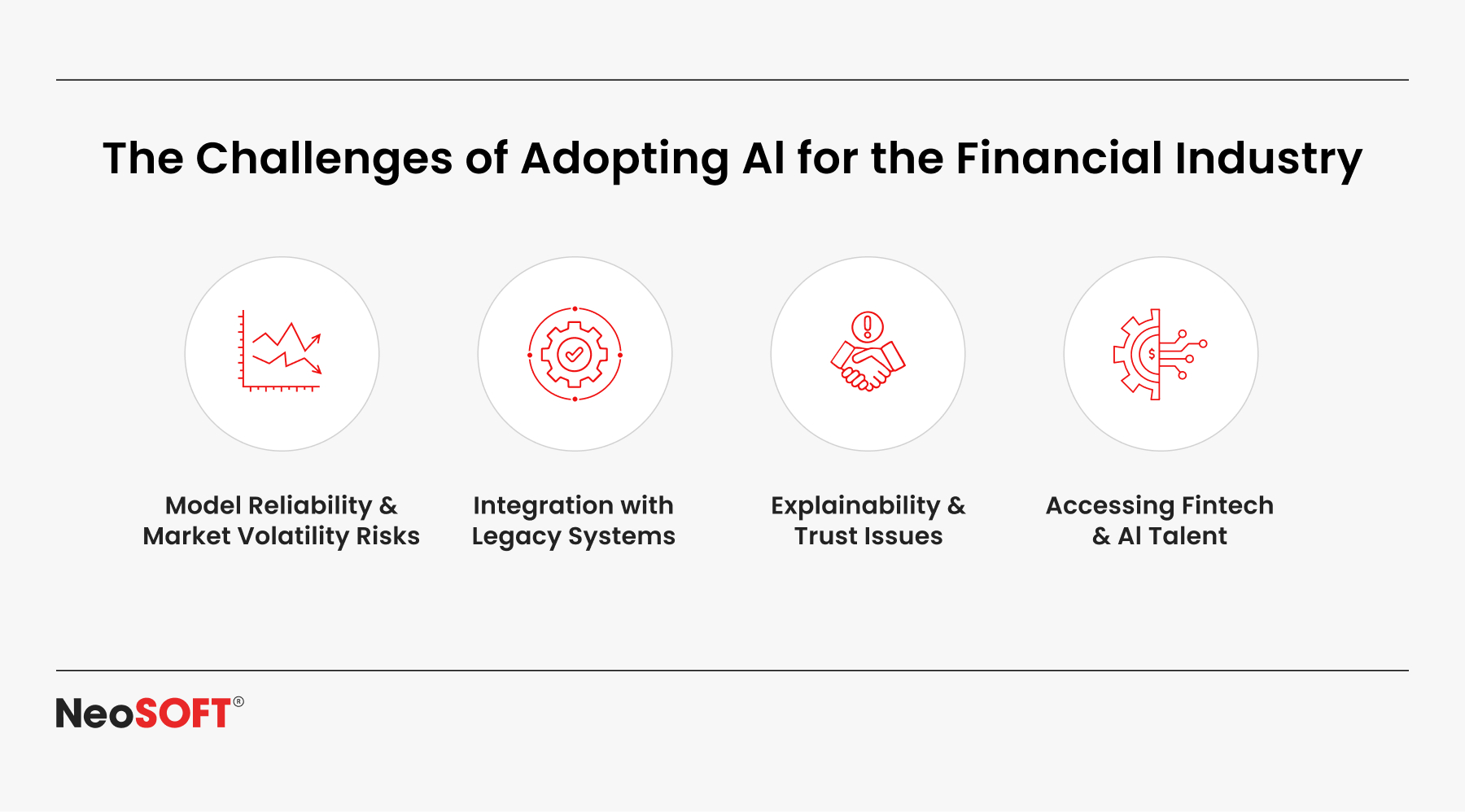

Challenges and Considerations

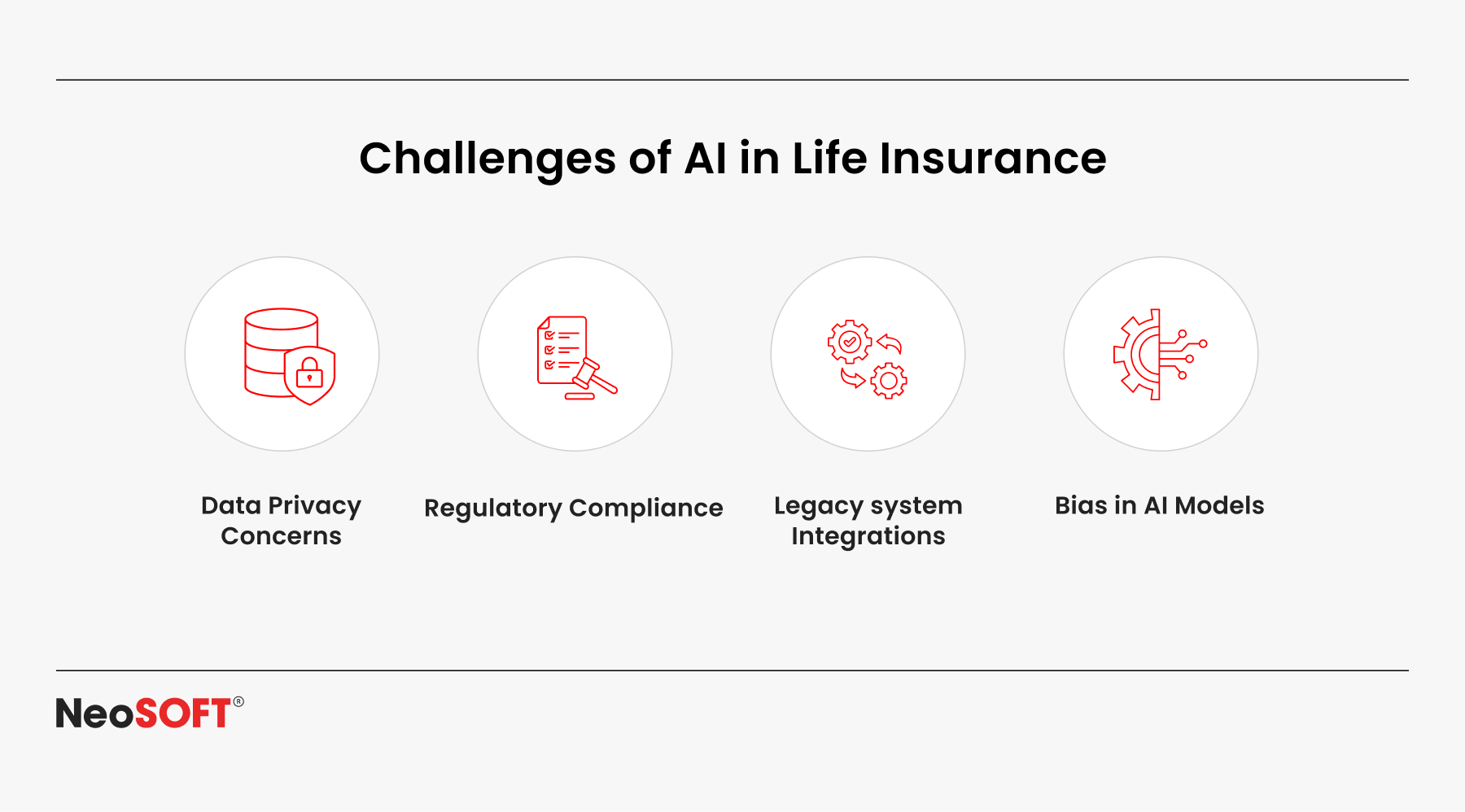

1. Ensuring Data Quality and Regulatory Compliance

When applying AI in finance, it is crucial that you make sure that the data is accurate, clean, and properly categorized because AI models function best when the data is of high quality.

2. Managing Bias in Training Models and Ensuring Fairness

The performance of AI models depends on the quality of their initial training data. AI systems may reinforce or even magnify biases in decision-making procedures if the data is biased. Using biased training data can end up in incorrect credit scoring or discriminatory lending practices.

3. Integrating with Legacy Systems Across the Banking Sector

A lot of major financial organizations continue to use outdated platforms that weren’t built to handle artificial intelligence. Merging these antiquated technologies with contemporary artificial intelligence methods can be difficult, expensive, and time-consuming. The frequent compartmentalization of legacy systems may render it a challenge for departments to work together and exchange data.

4. Hiring and Retaining Skilled Data Scientists

Artificially intelligent machines are only as good as those who create, develop, and manage them. There’s limited availability despite the strong need for skilled data professionals, machine learning specialists, and AI engineers. Financial institutions have to compete for the best employees by providing alluring benefits packages along with a work setting that promotes creativity and teamwork.

5. Building Trust in AI Systems

Organizations have to encourage trust in these systems if they want AI to become an essential aspect of financial services. This implies ensuring that stakeholders are able to fully understand the processes and making the AI models’ decision-making process clear. Clients and regulatory agencies should be informed of how AI-driven determinations are made, particularly in fields like fraud detection and credit assessment.

Conclusion: A Smarter, Faster, More Predictive Future

The banking and financial services sector is undergoing a change thanks to the convergence of artificial intelligence and machine learning. AI-powered solutions are giving financial institutions the tools that they require for staying ahead of the competition, from improving identification of fraud and deterrence to offering highly customized customer service.

Financial institutions can now anticipate future developments, find patterns in massive volumes of data, and make previously impractical judgments in real time because of these advances in technology. The ability to respond swiftly to customer expectations, whether through smarter investment platforms or faster loan approvals, gives organizations a significant competitive edge in today’s fast-paced market.

However, adopting machine learning systems isn’t just about keeping up, it’s about leading the way. Financial institutions that embrace these technologies will be better positioned to not only navigate the complexities of modern finance but also to drive innovation and efficiency across their operations today. The future is now, whether your goal is to set up a machine learning-powered making investments platform, modernize your lending operations, or use AI for managing risks.

We aim to assist you in developing intelligent, safe, and scalable solutions that will help you achieve your business objectives and position you for success.Enable us to help you in reaping the full advantages of machine learning and artificial intelligence. Contact us at [email protected] to start your path to a more bright and anticipating future.