Open Banking: Carving New Pathways Through Digital Transformation

The global enthusiasm around open banking has been soaring high as it sets a pace for the industry 4.0 to transform systematically through digital change and disruptive innovation. The transformation is just not limited to how banks would eventually evolve, but primarily aims at introducing value-added benefits for the customers and building a secure value chain.

Let’s dive into the concepts of open banking and understand the drivers that are fueling this innovation, the challenges and threats it poses, and how banks and other players plan to transform and develop new revenue models through the open banking channel.

What is Open Banking?

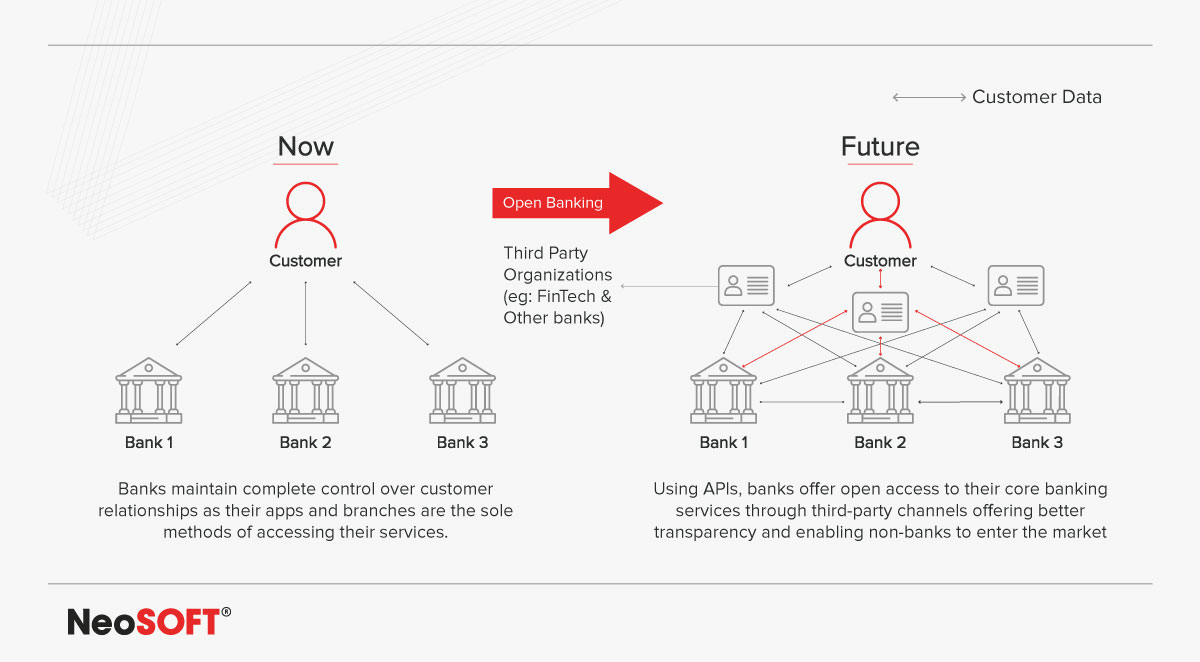

Open banking, also known as ‘open bank data’, is a platform-based approach that is destined to stay and evolve. It is a banking practice that provides third-party financial service providers with open access to consumer banking, transaction, and other financial data. The consumer data is captured from banks and non-bank financial institutions through the use of application programming interfaces (APIs).

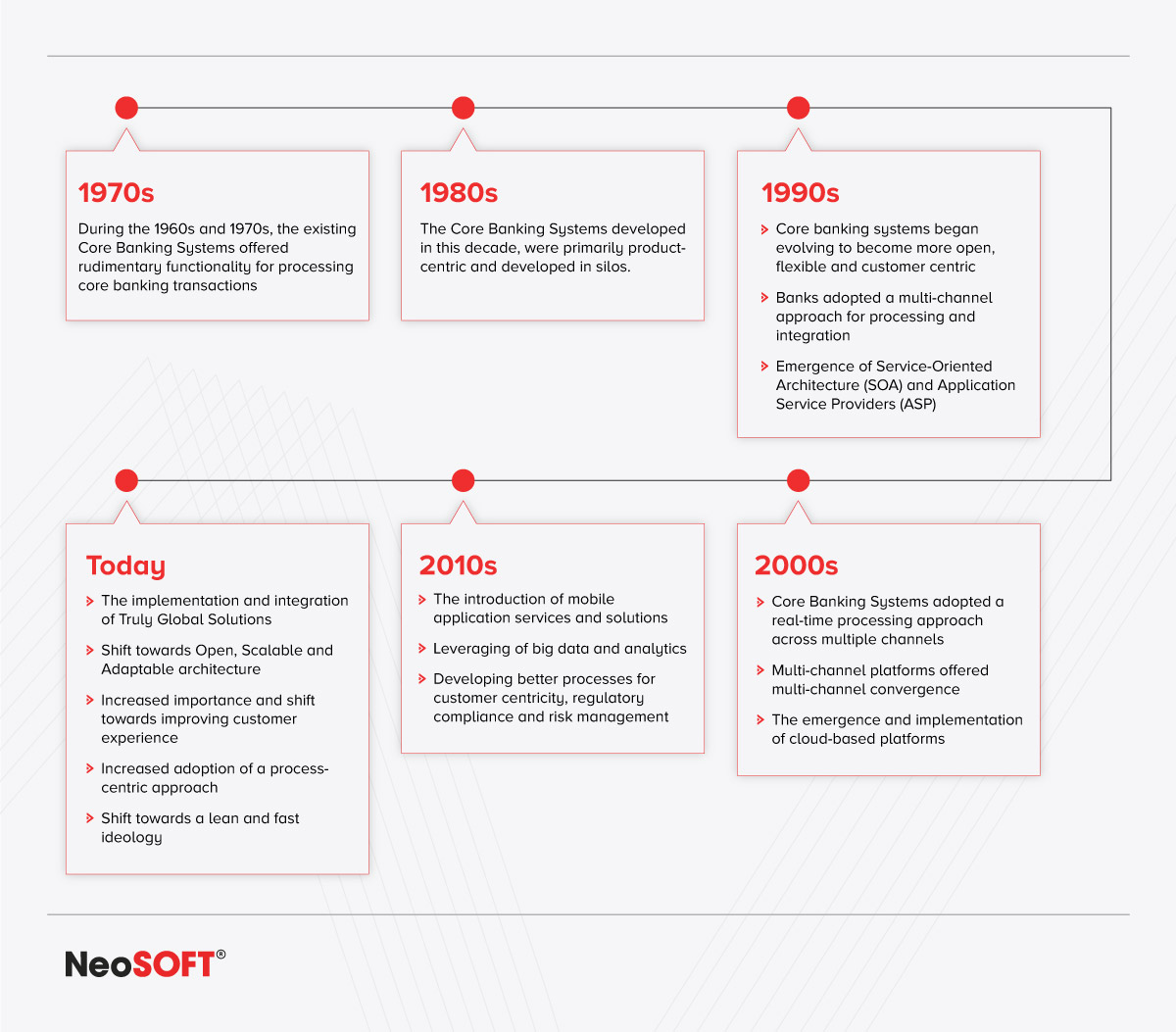

The Evolution of Open Banking

Financial institutions, since their inception, have been collecting precious information about their customers and their transactions, with little or no knowledge of how to harness this data to its effective value.

Today, financial institutions leverage the data to narrow down customers’ preferred choices and this includes everything from their favorite restaurant or coffee shop to which shops they buy most of their shirts. Financial institutions also capture non-consumer data known as meta-data from cash machines, branch locations, number of loans, mortgages, different account types, and volume of transactions. With all this data captured in heaps, it becomes easier to analyze customer preferences and suggest relevant products and services that could be of their interest.

Due to an increase of around 50% in access to additional customer data and an approximate 70% decrease in time to market, open banking is without a doubt garnering the most interest within the fintech industry.

If we think about the short term alone, open banking is expected to increase financial institutions’ revenue by at least 20%-30%. These numbers are jolting the fintech industry towards renewed innovation of banking and payment services, making it easier and more accessible for customers.

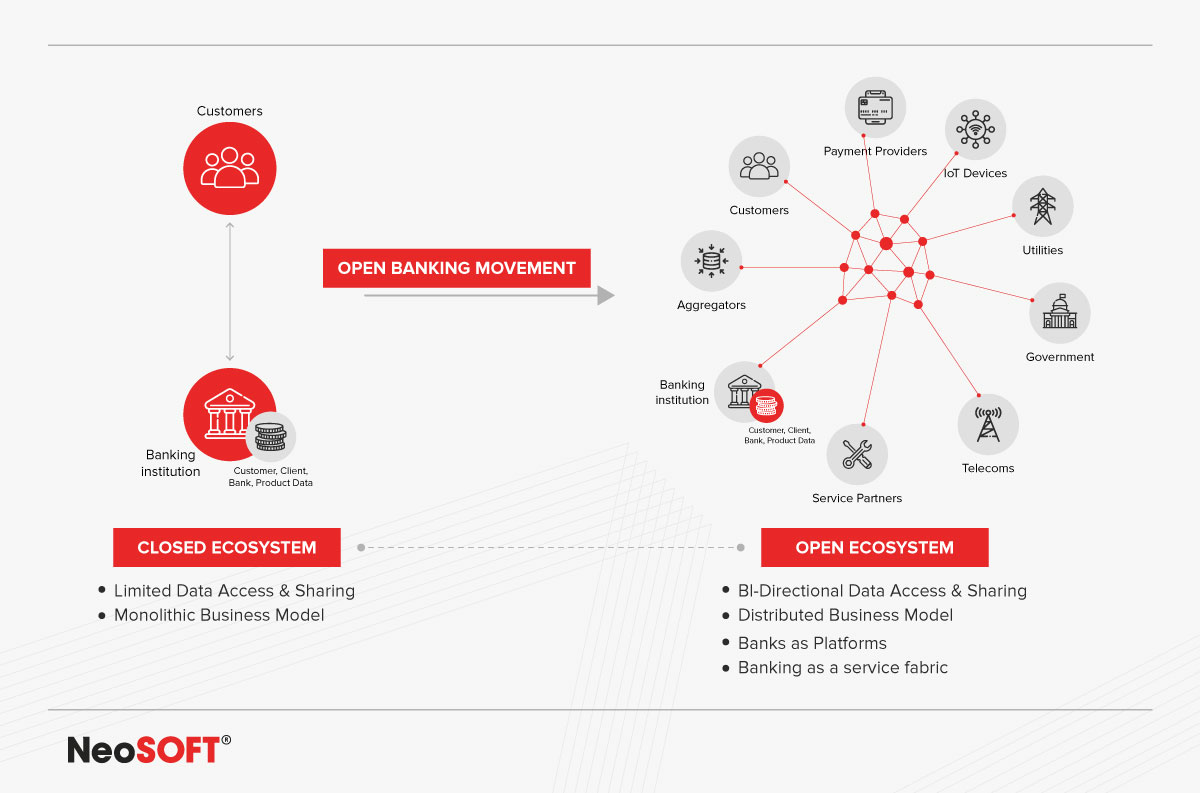

Conventional Banking Vs Open Banking

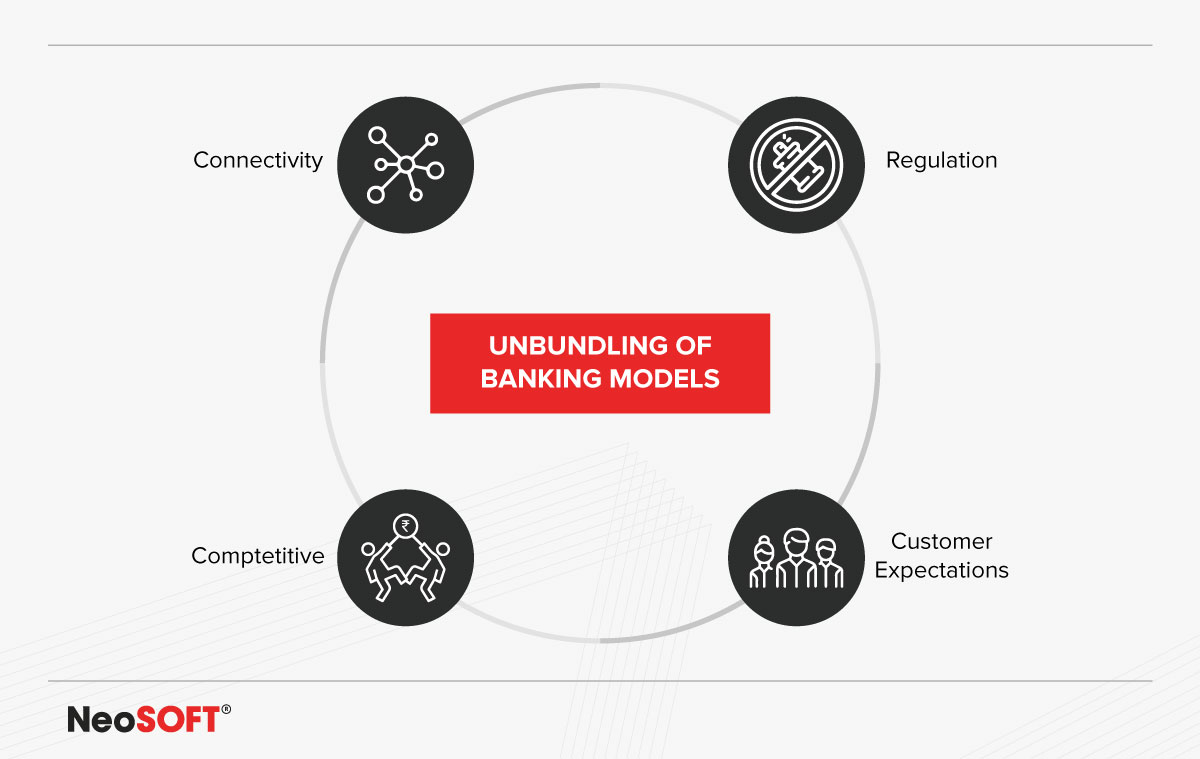

Driving Forces Behind Open Banking Adoption

Due to the global pandemic, the past few years have been quite challenging for financial institutions. This situation also built opportunities to innovate and introduce solutions that had the potential to drive a positive impact on their future profit goals.

1. Changing Customer Behavior and Expectation

Newer and older generations such as Generation Z or Generation Alpha, have distinctly different behavior and requirements, pushing financial institutions to rethink their process for creating and selling their products and services to them.

For instance, a bank has to consider whether the product or service they offer satisfies the customers’ needs or not. The shift from a product-centric approach to a customer-centric approach is important. This mindset has caused financial institutions to rethink and upgrade their offerings by keeping customer experience at the core of the product development process. Moreover, these days customers enjoy an unprecedented level of market transparency, and their satisfaction level goes beyond accepting a limited choice of products offered by their main bank. With exposure to frictionless user experiences, they can now quickly differentiate between a good and bad CX, and are now not in a state to accept anything mediocre.

2. Technology Fueled Innovation

Radical innovation in digital technology, exponential growth in smart devices, and the shift to instant payments, have opened new opportunities within financial services. Spurred on by the growth of APIs, they have now become the foundation of the entire open banking system. The integration of cloud-based platforms has further enhanced the agility, flexibility, and scalability of financial institutions’ abilities. Additionally, advancements in exponential technologies such as AI, real-time analytics, machine learning, and blockchain have further improved processes, services, and products across all levels.

3. Evolving Regulations

Governments across the globe have been ushered into taking a proactive approach to the “democratization” of financial products and services. Nudged on by EBA in the EU after the adoption of PSD2 in 2015, formally ushers in the concept of open banking. Regulation breeds innovations and naming the concept as ‘open’ denotes its explicit policy goal that the concept must be considered and adopted across all financial institutions. Compelling banks to make their proprietary data available to third-party providers.

4. Increased Competition

A large number of organizations – backed by technology giants like GAFA (Google, Amazon, Facebook, and Apple) – have entered the financial services market. These fintech organizations are providing quicker payment solutions, with seamless integration of cards, e-wallets, and other payment options fueling competition with the banks. As a matter of fact, these organizations are more ready and actively preparing to offer their services within the open banking ecosystem, further ramping up competition with banking institutions.

Unbundling of Banking Models

How Open Banking Will Take the Front Seat in the Financial Ecosystem

Currently, the ‘open revolution’ market consists of both: established financial institutions and new players. The range of applications begins from a ‘minimum approach’ that permits third-party access using APIs for the purpose of sharing selective data to ‘maximum implementation’ facilitates the integration of diverse functionalities by leveraging the Banking-as-a-Service platform (BaaS).

‘True’ open banking goes beyond the exchange of information and impacts the core elements of financial service providers including established processes and legacy core banking systems. They possess tremendous potential and allow players with varying needs to connect, therefore benefiting different bank types and the entire financial industry as a whole. The customers too benefit as they gain access to a wider range of products at a single touchpoint rather than reaching out to multiple service providers.

For some product categories like mutual funds, mortgage loans, or structured products, incorporating third-party products has been a common practice for banks for many decades thus far. This concept has also been applied to deposits, one of the most widely used products by bank customers and a major source of funding for banks.

Flexibility and a More Complex Competitive Environment

Driving Value for Stakeholders

The open banking ecosystem is geared toward a holistic benefit approach that considers its customers as well as the industry stakeholders. Outlined below are a few instances of value created by the innovation open banking platforms have adopted.

1. Flawless User Experience

Due to the potential convergence of open banking and artificial intelligence, user experience is undergoing an incredible digital transformation. The continuous influx of data across several sources enables service providers to determine the exact customer sentiments and requirements resulting in highly personalized financial offerings. Several tedious procedures are also expected to become simplified and automated. Through banking APIs, fintech firms offer users the opportunity to improve their financial lives through financial planning capabilities and insights based on their own data. Essentially, opening banking enables banks and similar financial institutions to create a unique financial profile for each customer according to their financial data. Allowing them to predict their consumption patterns and behavior to execute product customization more efficiently.

2. Real-Time Payments Facilitating Easier Treasury and Cash Management for SMEs

Open banking facilitates near-instantaneous payments, as third-party providers can bundle all payments within a single digital interface. Typically, SMEs don’t have their own treasury departments, unlike their bigger counterparts. Real-Time Payment (RTP) transforms treasury management services, driving value for SMEs through increased visibility of their cash flows and liquidity positions. RTP also speeds up the Peer to Peer (P2P) payments, bill payments, and e-commerce payments ecosystem.

3. Data Sharing Prompting Product Innovation and Financial Freedom

Open banking ensures that banks only share their customer’ data with authorized third parties. This will lead to the development of better financial products as organizations can leverage the data to extract customer insights and subsequently become more innovative and customer-centric.

4. APIs Enhancing Cross-Selling and Cost Optimization Opportunities

Open Banking offers banks the opportunity to blend product and service features offered by third-party providers to create their own offerings using APIs as a plug-and-play model. Tying together such readily available services from third-party providers and vice versa, banks can quickly improve customer service, boost customer loyalty, create new revenue streams, and decrease bank operating costs. Moreover, banks can mitigate the risk and expenses of experimenting with newer products simply by adopting the plug-and-play model of integrating APIs of third parties along with their core products on their digital platform.

5. Data Transparency

The need for building transparency might seem obvious, but each platform and disruptive technology comes with its own story and unique set of challenges. For open banking platforms, these challenges have given credence to the regulatory and similar competent authorities to focus on the need for building transparency by ensuring that the customers’ interests and rights are at the heart of all focus areas.

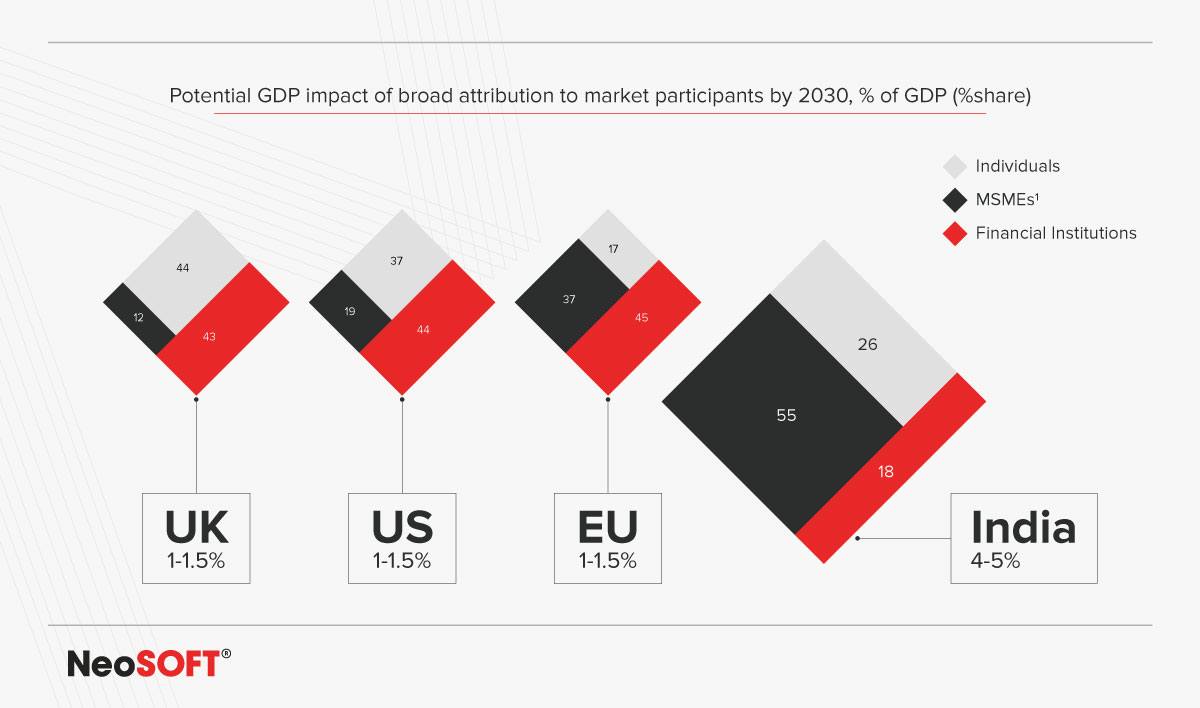

The potential impact of open financial data on GDP and how it varies according to different regions.

Risks and Challenges Banks Need to Consider to Succeed in the Open Banking Ecosystem

Although the advent of open banking has been largely positive for the financial sector, it has also opened up several new challenges and risks for banking institutions. Many of these will have far-reaching consequences for their business prospects, possibly reaching the point of existential crisis.

Let’s consider some of the key points:

1. Rise of New Competition

Leading banks are now being challenged by pure digital entities like GAFA. These fintech are attracting customers in heaps by providing unbundled, innovative, and engaging financial products and services. Meanwhile, many leading banks are still relying upon legacy systems, and if the threat is not addressed soon, will risk the prospect of losing their market share, greater customer churn, and increased pressure on margins.

2. Data Security

Sharing financial data through APIs to third-party providers bears the inherent risk of data security and breaches. The absence of industry-wide technical standards and data sharing protocols might leave operating processes vulnerable to security breaches and fraudulent activities. Using complicated interconnections of data access, banks need to invest heavily in security initiatives and risk mitigation, which often heavily impacts their bottom line. At the same time, banks cannot afford to miss out on the potential revenue generated by these data streams within the open banking ecosystem.

3. Risk of Commoditization

Due to open APIs, leading banks will face the risk of being commoditized. Reason: The elimination of several existing barriers to switching accounts and shopping around for other products based on price only. Banks face the likelihood that a significant portion of their customer base might turn to the convenience of digital aggregators, resulting in the migration of their accounts and the profit pools tied to them.

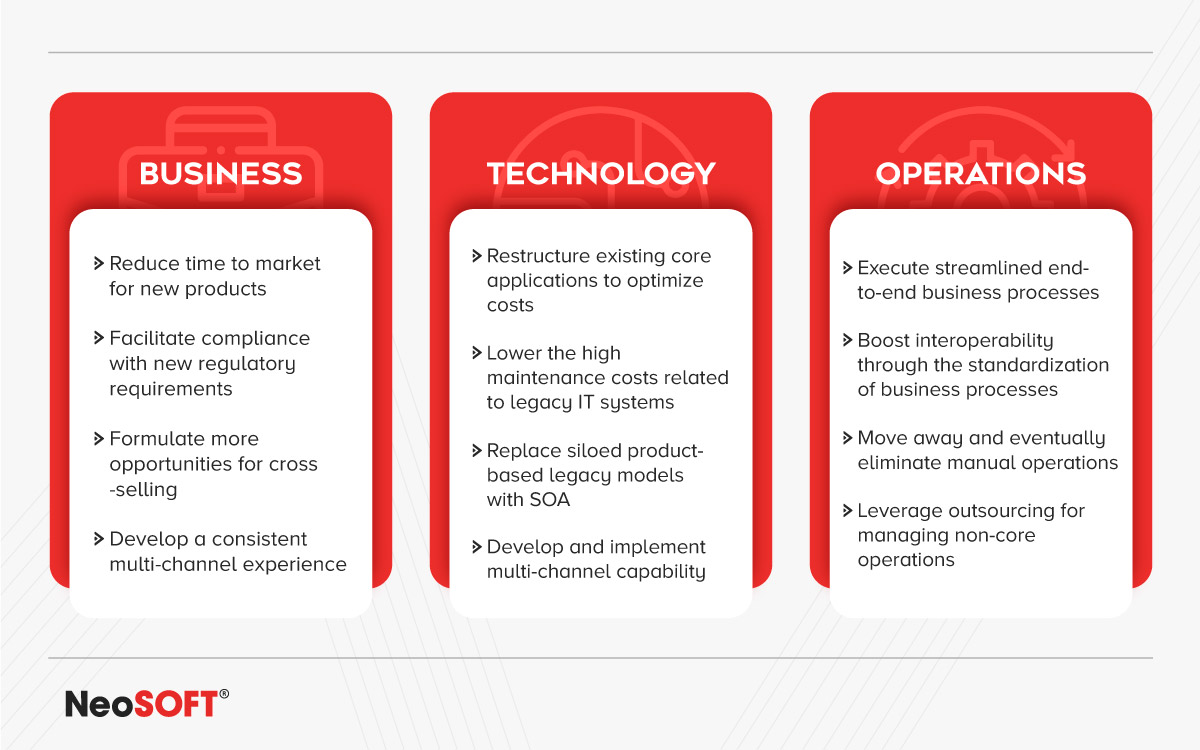

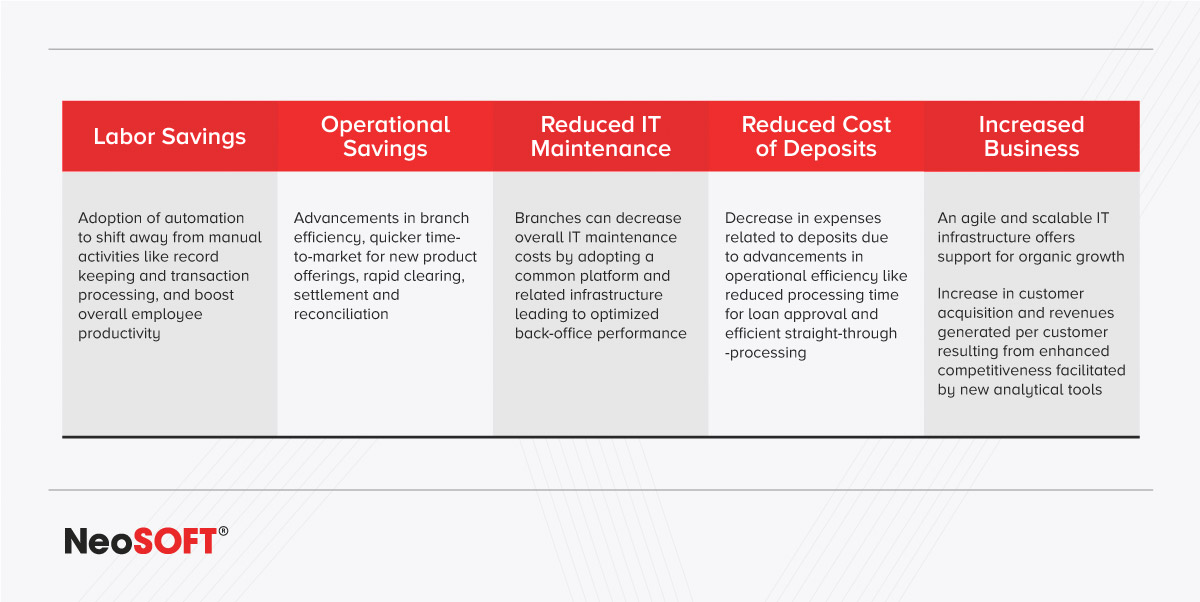

Sustaining Long Term Growth Through Business Transformation

The business transformation gained from adopting a platform-based open banking ecosystem will foster an environment that goes beyond incremental change and value delivery. It incorporates strategic choices that affect financial institutions’ growth – how they operate and the kind of improvements they can expect going forward.

Listed below are a few imperatives for creating long term growth for financial institutions:

- Improve the existing range of offerings by reinforcing the core through collaboration with third-party providers.

- Build new value propositions by incorporating customer needs and financial position within service integration. This will allow credit scoring, pricing of loans, and other products to be refined and curated on a more personal, almost one-to-one basis.

- Collaboration and partnership between banks, third-party providers, and merchants will create a marketplace-like ecosystem. Allowing financial products to be bundled along with other non-financial products leads to newer cross-selling opportunities.

- Diversify the traditional service portfolio by building strong API portfolios, boosting engagement with the developer community, and promoting cross-collaboration across marketplaces.

- Concentrate on the adoption of the Banking-as-a-Platform (BaaP) model with an API-enabled network of partners, allowing core services to be bundled with third-party providers – facilitating advisory, business management as well as traditional banking services.

It is clear that open banking is set to fundamentally alter the financial service landscape through innovative services and new business models. The emergence of fintech will bolster collaboration as well usher in a new ecosystem that will change the role of banks significantly. Also, there are several issues surrounding regulation and data privacy causing a varied approach toward implementation across countries. However, irrespective of their geography, the momentum gathered by open banking is high, requiring banks and other fintech institutions to increase collaboration with each to ensure success within this new emerging ecosystem.

NeoSOFT’s Use Cases

Financial institutions across the globe leverage our expert open banking capabilities to enhance their customer experience, boost innovation, and improve adherence to data security and governance. Take a glance at how our solutions have impacted clients…

Helping a leading bank enter new markets, extend its customer base and increase the volume of transactions.

NeoSOFT was tasked with helping the bank meet changing customer expectations by leveraging alternative tech solutions that help the client address their money management requirements. Our engineers devised solutions to establish fintech partnerships, facilitating an increase in account acquisition through APIs and growth in transaction volume

Facilitating high-velocity innovation through banking APIs and an API management platform for a renowned financial services provider.

The client wanted a defined organization-wide API strategy that aligns with overall business goals while maintaining autonomy. Our solutions enabled the client to build a single developer portal for all their branches to provide insight into API adoption patterns. Our team of engineers were also able to balance organization-wide governance and cross-geography oversight for better management.

Amplifying the API Management platform for one of the largest and most popular BFSI clients.

The requirement was to lay the foundation for loyalty-driving open banking services, increase compliance and accelerate internal integration to a secure API platform. Our solutions enabled the client to adhere to its regulatory obligations while delivering an innovative customer-facing service. Additionally, it also delivered a notable uptake in operational efficiency across the organization.